40-17G: Fidelity bond filed pursuant to Rule 17g1(g)(1) of the Investment Company Act of 1940

Published on November 12, 2024

November 12, 2024

Office of Registration and Reports

Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

RE: Gladstone Alternative Income Fund Fidelity Bond

Ladies and Gentlemen:

On behalf of Gladstone Alternative Income Fund (the Company), I enclose the following documents for filing pursuant to Rule 17g-1 of the Investment Company Act of 1940, as amended (the 1940 Act):

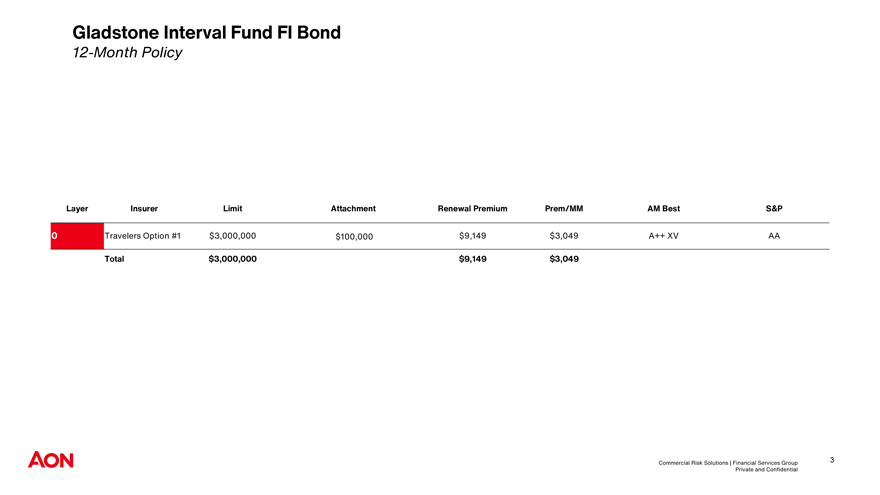

| 1. | A copy of the Companys Investment Company Bond No. 108160727, in the amount of $3,000,000, effective as of November 6, 2024, covering the Company, and its subsidiaries (the Bond). The Bond was received by the Company on November 6, 2024. |

| 2. | A copy of the resolutions adopted by written consent of the Board of Trustees dated October 24, 2024, in which a majority of the Trustees who are not interested ratified and approved the amendment to the Bond. |

The period for which premiums have been paid on behalf of the Company is November 24, 2024 to November 25, 2025. The Companys premium is $9,149.

Thank you for your assistance. Should you have any questions, please feel free to call me at 703-287-5872.

| Sincerely, |

| GLADSTONE ALTERNATIVE INCOME FUND |

| /s/ John A. Dellafiora Jr. |

| John A. Dellafiora Jr. |

| Chief Compliance Officer |

|

|

|||

| Anupama Muniyappa | ||||

| PO Box 2950 Hartford, CT 06104-2950 Phone: (312) 458-6687 Fax: 312) 917-4173 Email: AMUNIYAP@travelers.com |

||||

November 7, 2024

Justin Salazar

AON RISK SERVS CENTRAL

200 E RANDOLPH ST FL 9

CHICAGO, IL 60601

| RE: | Insured Name: | Gladstone Alternative Income Fund | ||

| Binder Type: | Informational | |||

| Product: | INVESTMENT COMPANY BOND | |||

| IVBB-15001 (01-16) | ||||

| Bond Number: | 108160727 | |||

| Bond Period: | November 06, 2024 to November 25, 2025 | |||

| Binder Expiration Date: | December 6, 2024 | |||

Dear Justin Salazar:

On behalf of Travelers Casualty and Surety Company of America we are pleased to bind coverage for the following Insurance.

INVESTMENT COMPANY BOND:

| Insuring Agreement |

Single Loss Limit of Insurance |

Single Loss Deductible Amount |

||||||

| A. FIDELITY |

||||||||

| Coverage A.1. Larceny or Embezzlement |

$ | 3,000,000 | $ | 0 | ||||

| Coverage A.2. Restoration Expenses |

$ | 3,000,000 | $ | 100,000 | ||||

| B. ON PREMISES |

$ | 3,000,000 | $ | 100,000 | ||||

| C. IN TRANSIT |

$ | 3,000,000 | $ | 100,000 | ||||

| D. FORGERY OR ALTERATION |

$ | 3,000,000 | $ | 100,000 | ||||

| E. SECURITIES |

$ | 3,000,000 | $ | 100,000 | ||||

| F. COUNTERFEIT MONEY AND COUNTERFEIT MONEY ORDERS |

$ | 3,000,000 | $ | 100,000 | ||||

| G. CLAIM EXPENSE |

$ | 100,000 | $ | 5,000 | ||||

| H. STOP PAYMENT ORDERS OR WRONGFUL DISHONOR OF CHECKS |

$ | 100,000 | $ | 5,000 | ||||

| I. COMPUTER SYSTEMS |

||||||||

| Coverage I.1. Computer Fraud |

$ | 3,000,000 | $ | 100,000 | ||||

| Coverage I.2. Fraudulent Instructions |

$ | 3,000,000 | $ | 100,000 | ||||

| Coverage I.3. Restoration Expense |

$ | 3,000,000 | $ | 100,000 | ||||

| J. UNCOLLECTIBLE ITEMS OF DEPOSIT |

$ | 100,000 | $ | 5,000 | ||||

If Not Covered is inserted opposite any specified Insuring Agreement above, or if no amount is included, in the Single Loss Limit of Insurance, such Insuring Agreement and any other reference thereto is deemed to be deleted from this bond.

| LTR-19040 Ed. 01-16 | Page 1 of 3 | |

| © 2016 The Travelers Indemnity Company. All rights reserved. |

| DISCOVERY PERIOD FOR BOND COVERAGE: | ||

| Additional Premium Percentage: |

100% of the annualized premium | |

| Additional Months: |

12 months | |

| TOTAL ANNUAL PREMIUM - $9,149.00 |

| (Other term options listed below, if available) |

PREMIUM DETAIL:

| Term |

Payment Type | Premium | Taxes | Surcharges | Total Premium | Total Term Premium |

||||||||||||||||||

| Transaction |

Prepaid | $ | 9,625.00 | $ | 0.00 | $ | 0.00 | $ | 9,625.00 | $ | 9,625.00 | |||||||||||||

| BOND FORMS APPLICABLE: | ||

| IVBB-15001-0116 |

Investment Company Bond Declarations | |

| IVBB-16001-0116 |

Investment Company Bond | |

| ENDORSEMENTS APPLICABLE: | ||

| IVBB-18032-0116 |

Virginia Cancelation, Termination, Change or Modification Endorsement | |

| IVBB-19003-0116 |

Social Engineering Fraud Insuring Agreement - Enhanced | |

| IVBB-19010-0116 |

Unauthorized Signature Endorsement | |

| IVBB-19014-0116 |

Non-Accumulation Endorsement | |

| Company Name |

Gladstone Management Corporation, Gladstone Capital Corporation and Gladstone Investment Corporation |

|

| IVBB-19038-0422 |

Global Coverage Compliance Endorsement | |

| IVBB-19044-0518 |

Automatic Increase In Insuring Agreement A.1. Single Loss Limit of Insurance Endorsement | |

| IVBB-19045-0319 |

Replace General Agreement A. Organic Growth Endorsement | |

| IVBB-19046-0919 |

Amend Limit Of Insurance Under This Bond And Prior Insurance Endorsement | |

CONTINGENCIES:

This binder is contingent on the acceptable underwriting review of the following information prior to the Binder expiration date.

None

This binder is a conditional binder, valid until December 6, 2024. This binder will expire on the noted date, at the noted time, unless the required underwriting information stated in the Contingencies section is provided to Travelers and then reviewed and accepted by Travelers prior to the noted expiration date and time.

This bond will not take effect unless Underwriting Information is received and satisfactorily reviewed by December 6, 2024 (Binder Expiration Date). If you do not submit the Underwriting Information on or before the Binder Expiration Date, no bond will be issued.

COMMISSION: 15.00%

NOTES:

NOTICES:

It is the agents or brokers responsibility to comply with any applicable laws regarding disclosure to the bondholder of commission or other compensation we pay, if any, in connection with this bond or program.

| LTR-19040 Ed. 01-16 | Page 2 of 3 | |

| © 2016 The Travelers Indemnity Company. All rights reserved. |

Important Notice Regarding Compensation Disclosure

For information about how Travelers compensates independent agents, brokers, or other insurance producers, please visit this website: http://www.travelers.com/w3c/legal/Producer_Compensation_Disclosure.html

If you prefer, you can call the following toll-free number: 1-866-904-8348. Or you can write to us at Travelers, Agency Compensation, P.O. Box 2950, Hartford, CT 06104-2950.

Sincerely,

Anupama Muniyappa

Travelers Bond & Specialty Insurance

| LTR-19040 Ed. 01-16 | Page 3 of 3 | |

| © 2016 The Travelers Indemnity Company. All rights reserved. |

GLADSTONE ALTERNATIVE INCOME FUND

Written Consent of the Board of Trustees

October 24, 2024

Pursuant to Article III, Section III.9 of the Amended and Restated Declaration of Trust of Gladstone Alternative Income Fund, a Delaware statutory trust (the Fund), and Section 3806(g)(1) of the Delaware Statutory Trust Act, the undersigned, being all of the Trustees of the Fund, do hereby consent and agree to the following actions, which shall for all purposes be treated as action taken at a meeting of the Board of Trustees (the Board) duly called and held, and shall be effective when executed by the requisite number of Trustees and filed with the minutes of the Board:

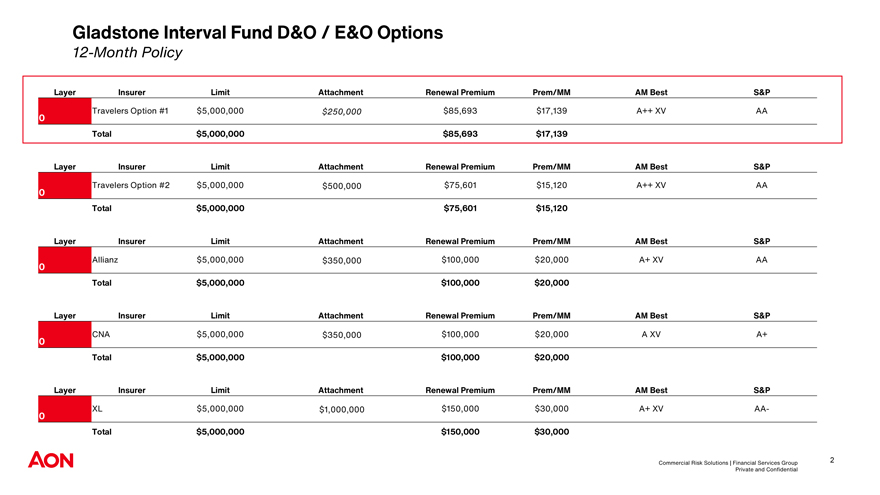

RESOLVED, that the officers of the Fund be, and each of them acting singly hereby is, authorized to enter into a liability insurance policy maintained by Travelers Casualty and Surety Company of America, in the amount and with the deductible set forth for Travelers Option #1 in Exhibit A hereto, which will cover the Fund and its Trustees and officers (each of whom shall be deemed a third-party beneficiary thereof) generally against liabilities and expenses arising out of claims, actions or proceedings asserted or threatened against them in their respective capacities for or relating to the Fund, subject to such ordinary exceptions as the officer executing the same, deems reasonable or appropriate; and be it

FURTHER RESOLVED, that the Funds participation in the above-referenced liability insurance policy is in the best interests of the Fund; and be it

FURTHER RESOLVED, that the Fund shall be named as an insured under a fidelity bond maintained by Travelers Casualty and Surety Company of America, having coverage that complies with Rule 17g-1 under the Investment Company Act of 1940, as amended (the 1940 Act) and issued by a reputable fidelity insurance company, against larceny and embezzlement and such other types of losses as are included in standard fidelity bonds, covering the officers and other employees of the Fund from time to time, containing such provisions as may be required by the rules promulgated under the 1940 Act; and be it

FURTHER RESOLVED, that the fidelity bond in the amount of $3 million be, and the same hereby is, approved, subject to such negotiations and changes as the officers of the Fund, with the advice of counsel, may deem appropriate, after consideration of all factors deemed relevant by the Board, and including a majority of the Trustees who are not interested persons (as defined in Section 2(a)(19) of the 1940 Act) of the Fund, including the amount of the bond, the expected value of the assets of the Fund to which any person covered under the bond may have access, the estimated amount of the premium of such bond, the type and terms of the arrangements made for the custody and safekeeping of the Funds assets, and the nature of the securities in the Funds portfolio; and be it

FURTHER RESOLVED, that the officers of the Fund be, and each of them acting singly hereby is, authorized to enter into said fidelity bond; and be it

FURTHER RESOLVED, that the Chief Compliance Officer of the Fund be, and hereby is, designated as the party responsible for making the necessary filings and giving the notices with respect to such bond required by paragraph (g) of Rule 17g-1 under the 1940 Act.

IN WITNESS WHEREOF, the undersigned have hereunto caused this written consent to be executed as of the date first set forth above.

| /s/ David Gladstone |

| David Gladstone as Trustee |

| /s/ Paula Novara |

| Paula Novara as Trustee |

| /s/ Paul W. Adelgren |

| Paul W. Adelgren as Trustee |

| /s/ Michela A. English |

| Michela A. English as Trustee |

| /s/ Katharine C. Gorka |

| Katharine C. Gorka as Trustee |

| /s/ John H. Outland |

| John H. Outland as Trustee |

| /s/ Anthony W. Parker |

| Anthony W. Parker as Trustee |

| /s/ Walter H. Wilkinson, Jr. |

| Walter H. Wilkinson, Jr. as Trustee |

2

Exhibit A Insurance Proposal

3

Gladstone Alternative Income Fund Management Liability & FI Bond Proposal Todays Date: October 18th, 2024 Effective Date: 12 months from effectiveness of SEC registration

Gladstone Interval Fund D&O / E&O Options 12-Month Policy Layer Insurer Limit Attachment Renewal Premium Prem/MM AM Best S&P Travelers Option #1 $5,000,000 $250,000 $85,693 $17,139 A++ XV AA Total $5,000,000 $85,693 $17,139 Layer Insurer Limit Attachment Renewal Premium Prem/MM AM Best S&P Travelers Option #2 $5,000,000 $500,000 $75,601 $15,120 A++ XV AA Total $5,000,000 $75,601 $15,120 Layer Insurer Limit Attachment Renewal Premium Prem/MM AM Best S&P Allianz $5,000,000 $350,000 $100,000 $20,000 A+ XV AA Total $5,000,000 $100,000 $20,000 Layer Insurer Limit Attachment Renewal Premium Prem/MM AM Best S&P CNA $5,000,000 $350,000 $100,000 $20,000 A XV A+ Total $5,000,000 $100,000 $20,000 Layer Insurer Limit Attachment Renewal Premium Prem/MM AM Best S&P XL $5,000,000 $1,000,000 $150,000 $30,000 A+ XV AA- Total $5,000,000 $150,000 $30,000 Commercial Risk Solutions | Financial Services Group Private and Confidential 2

Gladstone Interval Fund FI Bond 12-Month Policy Layer Insurer Limit Attachment Renewal Premium Prem/MM AM Best S&P Travelers Option #1 $3,000,000 $100,000 $9,149 $3,049 A++ XV AA Total $3,000,000 $9,149 $3,049

Subjectivities Travelers D&O / E&O None Travelers FI Bond Completed, signed and dated application

Compensation for the Value We Deliver Aon is an insurance broker and, when serving as your retail insurance broker, in addition to or in lieu of compensation you may pay, Aon may earn compensation which relates in whole or in part to your insurance placement. For policy level commissions, Aon endeavors to receive compensation using standard commission rates by line of business that we seek to achieve with insurers in advance of individual policy placements. We believe this creates a fairer marketplace among insurers and allows our insurers to focus on the clients needs and risk history, not on commission rate negotiation. In turn, because insurers will be evaluated on their capabilities, clients will be able to more easily compare quotes. Aons standard commission rates differ by line of business and, when placed in the U.S. market, are up to the following commission rates: Aviation, 17.5%; Casualty, 18.5%; Cyber, 17.5%; Energy, 20%; Entertainment, 20%; Environmental, 18%; Marine 20%; Med Mal/ Healthcare, 17.5%; Professional/ E&O,17.5%; Property, 18%; Product Recall, 20%; Financial Lines, 18%; Healthcare, 20%; Surety, 35%; Terrorism, 25%; Trade Credit, 17.5%; and Workers Compensation, 15%. Where an Aon broker is placing a policy in the London or Bermuda market, Aon endeavors to earn 20% on those lines of business. Where Aon has created a facility with proprietary terms and conditions negotiated, the Aon standard commission rates range from 20%22.5%. Some lines of business are not conducive to standardization because they are subject to state filing regulations, state-specific rates and/or industry-specific rates. The standard commission rates we achieve do not include program business (e.g.: franchises, sponsored groups) or large deductible programs. In addition, Aon provides certain administrative and other related placement services to markets. Compensation of up to 7.5% for these services may take the form of a national additional commission (NAC) or a subscription market brokerage (SMB). Collecting these commissions will not change the premium quoted. Compensation paid to Aon may vary based upon a number of factors, including the insurance contract and the insurer you select, the volume of business and/or profitability of business we place with each insurer. Therefore, Aon may be considered to have an incentive to place insurance coverages with a particular insurance company. We strive for transparency with each Client and the final decision regarding coverage and market options is the Clients decision. If you are interested in receiving Aons standard commission grid and/or a Commission Disclosure Report identifying the individual commission rates on your placements or compensation expected to be received based in whole or in part on any alternative quotes, ask your Account Executive or write us at aon.us.broking@aon.com.

Commercial Risk Solutions U.S. Business Terms As Your broker of record, Commercial Risk Solutions U.S. (Aon, We or Us or Our) commits to the timely and thorough disclosure of placement strategies, marketing options and broking results. The services We provide to You, Our client (Client or You or Your) will be subject to these Business Terms which, unless You and We agree in writing otherwise, are applicable to Our services to You. Our Services We deliver Our services based on the information You give Us or which is given to Us expressly on Your behalf. In preparation for placing or renewing Your insurance coverage, We will consult with You regarding insurance market conditions, the insurers We suggest be approached, Our recommended program options to pursue, and Our marketing strategy on Your behalf. By the conclusion of the marketing process, We will provide You with written information regarding the coverage details, policy terms and conditions provided by the markets. We will assist You in gathering and preparing the underwriting information and completing insurance applications. We rely on You for the accuracy and completeness of any information You or anyone else provides to Us on Your behalf. We will also rely on You to provide Us promptly with the information needed to deliver the services and to update any information provided where there has been a material change to that information that may affect the scope of delivery of the services, such as the nature of the risk, the insured entities, property values and descriptions of persons to be covered. Applications requiring signature will be signed by You. We will obtain Your instructions to Us to bind specific programs based on the program proposal We provide. We expect You to carefully review all documents We give You, including binders, policies and endorsements, and to advise Us immediately if You detect any mistakes or believe the contents do not address Your needs or instructions. Aon will administer Your relationship with insurance companies including, where applicable, issues such as billings in connection with selected programs, data reporting, and compliance with negotiated requirements. We will provide services unless and until either of Us notifies the other that Aon is no longer acting as Your broker of record. Subject to applicable state law and contractual arrangements with insurers, any commissions to which We were entitled are fully earned. Surplus Lines and Other Government Taxes Insurance may not be available in the admitted marketplace for the terms and conditions specified by the Client. In such event, Aons insurance proposal may include one or more insurers not licensed to transact insurance in the states of exposure and such coverage may be placed as surplus lines coverage pursuant to applicable insurance laws governing the placement of insurance with non-admitted insurers. Persons and entities insured by surplus lines insurers cannot avail themselves of the protection and recovery afforded by the state insurance guaranty funds in the event the surplus lines insurer should become insolvent. The states do not audit the finances or review the solvency of surplus lines insurers. In some instances, these insurance placements made by Aon or its affiliates on the Clients behalf may require the payment of state surplus lines, excise or other taxes and/or fees in addition to the premium itself. Aon will endeavor to identify any such tax and/or fee in advance, but in all instances the payment of these taxes and/or fees will remain the responsibility of the Client. Aon will invoice the Client for the payment of such taxes and fees where it is Aons responsibility to do so.

Commercial Risk Solutions U.S. Business Terms Continued Client Responsibilities Aon will deliver the Included Services based upon the information that the Client and its representatives provide. The Client is responsible for the accuracy and completeness of the information and Aon accepts no responsibility arising from the Clients failure to provide such information to Aon. Aon must receive promptly the information to deliver the Included Services as well as the Clients prompt updates to any information where there has been a material change which may affect the scope or delivery of the Included Services, such as a change in the nature of the risk, insured entities, property values and persons or entities to be covered. To the extent that any portion of Aons compensation, by operation of law, agreement or otherwise, becomes adjusted or credited to the Client, it is the Clients responsibility to disclose the actual net cost of the brokerage and insurance costs You have incurred to third party(ies) having an interest in such amounts. Claims Notification to Insurers Unless Aon has a specific signed agreement with the Client to the contrary, it is the Clients responsibility to take such steps as are necessary to notify directly those insurers whose policies may apply to any circumstances, occurrences, claims, suits, demands and losses in accordance with the terms and conditions of Your policies. Aon assumes no duty or responsibility with respect to such notifications or monitoring the Clients obligation to place insurers on notice unless undertaken in a separate written agreement. The Client may send copies of such notices to members of Aon staff for informational purposes only, but the receipt of such notice by Aon shall not create additional duties or obligations owed by Aon to the Client nor constitute notice to Your insurers. Contract and Lease Review; General Advice In instances where Aon provides summaries of contractual requirements or provisions, or any suggested additional or alternative wordings to any contract or lease at the Clients request, such language must be reviewed by the Clients legal advisor before You take action based upon Aons statements. Aon does not and cannot provide legal advice as to whether the Clients insurance program covers legal obligations contained in the Clients contracts or leases. All descriptions of the insurance coverages are subject to the terms, conditions, exclusions and other provisions of the policies or any applicable regulations, rating rules or plans. Furthermore, it is understood that none of the services provided by Aon are of a legal nature and Aon shall not give legal opinions or provide legal advice or representations. Confidentiality Aon takes client confidentiality seriously. We have established controls to protect Your information. We are willing to enter an agreement as You may require for the protection of Your confidential data. The Client acknowledges and agrees that the work products provided by Aon are not to be distributed, used or relied upon by third parties without the written consent of both Aon and the Client, except as may be required by Your legal, accounting and non-insurance financial advisors who agree to be bound by this confidentiality agreement. Intermediaries Aon encourages its retail brokers to approach markets directly (without an intermediary) wherever possible. However, where Aon believes it is in the Clients best interest, We may recommend the use of intermediaries, including but not limited to co-brokers, sub-brokers, managing general agents/managing general underwriters, wholesale brokers, or reinsurance brokers (collectively, Intermediary) to assist in the procurement and servicing of the Clients insurance. Aon prefers, wherever possible, to use the services of an Aon-affiliated Intermediary and Aon shall not be responsible for a non-Aon affiliated Intermediarys actual or alleged acts, errors, or omissions or those of its officers, directors or employees. Any and all compensation earned by an Intermediary in connection with the programs shall be in addition to the compensation paid to Aon and shall not be credited against the Fee, if any.

Commercial Risk Solutions U.S. Business Terms Continued Intermediaries Aon encourages its retail brokers to approach markets directly (without an intermediary) wherever possible. However, where Aon believes it is in the Clients best interest, We may recommend the use of intermediaries, including but not limited to co-brokers, sub-brokers, managing general agents/managing general underwriters, wholesale brokers, or reinsurance brokers (collectively, Intermediary) to assist in the procurement and servicing of the Clients insurance. Aon prefers, wherever possible, to use the services of an Aon-affiliated Intermediary and Aon shall not be responsible for a non-Aon affiliated Intermediarys actual or alleged acts, errors, or omissions or those of its officers, directors or employees. Any and all compensation earned by an Intermediary in connection with the programs shall be in addition to the compensation paid to Aon and shall not be credited against the Fee, if any. Collection and Use of Client Information Aon gathers data containing information about the Client and Your insurance placements, as well as information about the insurance companies that provide coverage to the Client or compete for the Clients insurance placements. In addition to the information provided by the Client, Aon may collect information from commercially available sources. Such information may include name, address, email address and demographic data. This information may be shared among Aon affiliated businesses, as well as with third-party service providers acting on Our behalf. In addition to being used to provide services to Aons customers, the information may be used for business administration, business reporting, statistical analysis, marketing of Aon products or services and providing consulting or other services to insurance companies for which Aon or its affiliates may receive remuneration. Aon takes appropriate measures to protect the privacy and confidentiality of Our customers as well as to comply with applicable laws and regulations. Aon may use or disclose information about Our customers if We are required to do so by law, Aon policy, pursuant to legal process or in response to a request from law enforcement authorities or other government officials. Due to the global nature of services provided by Aon, the personal information the Client provides may be transmitted, used, stored and otherwise processed outside of the country where the Client submitted that information. Use of Logos Unless otherwise instructed by the Client, Aon will use the Clients logo, pictures, and other publicly available information to effectively market the Clients Programs or for use in Aons business records. Jury Waiver Each party agrees to waive its right to a trial by jury in any lawsuit or other legal proceeding against the other party and/or its parent(s), affiliates, or subsidiaries, in connection with, arising out of or relating to these Commercial Risk Solutions U.S. Business Terms or any services provided to the Client by Aon or its affiliates. In any such action or legal proceeding, neither party shall name, as a defendant any individual employee, officer or director of the other party or its parent(s), affiliates or subsidiaries.

Commercial Risk Solutions U.S. Business Terms Continued Premium Remittance Premiums paid by the Client to Aon for remittance to insurers and Client premium refunds paid to Aon by insurance companies for remittance to the Client are deposited into fiduciary accounts in accordance with applicable insurance laws until they are due to be paid to the insurance company or the Client. Subject to such laws and the applicable insurance companys consent, where required, Aon will retain the interest or investment income earned while such funds are on deposit in such accounts Insurance Proposals and Summaries Aons insurance documents containing proposals to bind coverage, summaries of coverages, and certificates of insurance placed are furnished to clients as a matter of information for Our clients convenience. These documents summarize proposed and placed policies and are not intended to reflect all the terms, conditions and exclusions of such policies. Moreover, the information contained in these documents reflects proposed or placed coverage as of the effective dates of the proposed policies or the date of the summaries and does not include subsequent changes. These documents are not themselves insurance policies and do not amend, alter or extend the coverages afforded by the proposed or placed policies. The insurance afforded by the proposed or placed policies is subject to all the terms, conditions and exclusions contained in such policies as they are issued by the insurers. Insurer Solvency While Aon only engages insurers who meet certain requirements as established by Us from time to time, We make no representation, guarantee or warranty as to the solvency or ability of any insurer to pay any amounts for insurance claims or otherwise. Pricing Aon does not and cannot guarantee the availability or price of insurance for Your risks and will not be responsible for fluctuation in the premiums charged by insurers. We will rely on You to review and approve calculation or estimation of premium and Aon is not responsible for any loss occasioned as a result of Our calculation or estimation of premium and statutory charges that may apply to Your insurance. Mutual Limited Waiver of Liability Neither party to these Commercial Risk Solutions U.S. Business Terms shall be liable to the other for any indirect, incidental, special, consequential, exemplary, punitive or reliance damages (including, without limitation, lost or anticipated revenues, lost business opportunities or lost sales or profits, whether or not either party has been advised of the likelihood of such damages) or for any attorneys fees (whether incurred in a dispute or an action against the other, or as alleged damages that any party incurred in any insurance coverage dispute, or otherwise) arising out of services provided by Aon or its affiliates. Standard Terms and Conditions Aon assumes no responsibility for the adequacy or effectiveness of programs or coverages that We did not implement or place. Any loss control services, summaries and/or surveys performed by Aon are advisory in nature and are for the sole purpose of assisting the Client in Your development of Your risk control and safety procedures. Such services and/ or surveys are limited in scope and do not constitute a safety inspection nor verify that the Client is in compliance with federal, state and local laws, statutes, ordinances, recommendations, regulations, consensus codes or other standards.

Commercial Risk Solutions U.S. Business Terms Continued Insurance Producers Role and Compensation The role of the insurance producer such as Aon in any particular transaction involves review with insurance purchasers about the benefits and terms and conditions of insurance contracts and selling insurance. Compensation is paid to the producer based on the insurance contract the producer sells. Depending on the insurer(s) and insurance contract(s) the purchaser selects, as well as the arrangement between the producer and the purchaser, compensation will be paid by the insurer(s) selling the insurance contract or by another third party. Such compensation may vary depending on a number of factors, including the insurance contract(s) and the insurer(s) the purchaser selects. Unless applicable state law and regulation or contractual agreement between Aon and insurers states otherwise, any commission that Aon is entitled to receive for any placements is fully earned at inception of the insurance programs described in Our insurance proposals and Aon is entitled to retain such commissions in the event of a midterm cancellation of coverage or a reduction in coverage resulting in a premium adjustment. To the extent that any portion of Aons compensation as reflected on its invoices becomes adjusted or credited to Our client, it is the clients responsibility to disclose the actual net cost to the client of the brokerage and insurance costs incurred to third party(ies) having an interest in such amounts. In placing, renewing, consulting on or servicing Your insurance coverages, Aon and its affiliates (Aon) may participate in contingent commission arrangements with insurance companies that provide for additional compensation, if, for example, certain underwriting, profitability, volume or retention goals are achieved. Such goals are typically based on the total amount of certain insurance coverages placed by Aon with the insurance company or the overall performance of the policies placed with that insurance company rather than on an individual policy basis. As a result, Aon may be considered to have an incentive to place Your insurance coverages with a particular insurance company. You may obtain information about compensation expected to be received by Aon based in whole or in part on the sale of insurance to You, and (if applicable) compensation expected to be received based in whole or in part on any alternative quotes presented to You by Aon by contacting Your Account Executive or emailing: Aon.US.Broking@aon.com Limitation of Liability Aons liability to the Client, in total, for the duration of Our business relationship for any and all damages, not otherwise waived under these Commercial Risk Solutions U.S. Business Terms, including costs, expenses and attorneys fees incurred in any underlying action by the Client that may be or are characterized as compensatory or other damages, whether based on contract, tort (including negligence), or otherwise, in connection with or related to Our services (including a failure to provide a service) or any other service that We provide shall be limited to a total aggregate amount of US $2.5 million (Liability Limitation), to the fullest extent permitted by law. This Liability Limitation shall apply to the Client and extend to the Clients parent(s), affiliates, subsidiaries, and their respective directors, officers, employees and agents (hereinafter, each a Client Group Member and together, Client Group) wherever located that seek to assert claims against Aon, and its parent(s), affiliates, subsidiaries and their respective directors, officers, employees and agents (each an Aon Group Member and together, Aon Group). Nothing in this Liability Limitation section implies that any Aon Group Member owes or accepts any duty or responsibility to any Client Group Member. If the Client or any Client Group Member asserts any claims or makes any demands against Commercial Risk Solutions or any Aon Group Member for a total amount in excess of this Liability Limitation, then the Client agrees to indemnify Aon for any and all liabilities, costs, damages and expenses, including attorneys fees, incurred by Commercial Risk Solutions or any Aon Group Member that exceeds this Liability Limitation.

Disclosures Aon is an insurance broker and, when serving as your retail insurance broker, in addition to or in lieu of compensation you may pay, Aon may earn compensation which relates in whole or in part to your insurance placement. Such compensation may vary based upon a number of factors, including but not limited to the involvement of third parties, the insurance contract and the insurer you select, if we perform administrative activities at the time of placement or during the period of insurance in relation to specific products and facilities which facilitate the insurers own activities, as well as the volume and/or profitability of business we place with each insurer.